Predicting stock prices accurately can bring down the gamble of a speculation and raise the return. The proposed model, named MS-SSA-LSTM that utilizes mind-set investiga- tion, the multitude knowledge calculation, and profound figuring out how to foresee future stock costs in light of a blend of various sorts of information that influences stock costs. To start with, we glance through all of the East Cash string presents on make an exceptional state of mind word reference and sort out the feeling list. Then, at that point, the Long Short-Term Memory network (LSTM) hyperparameters are improved by the Sparrow Search Algorithm (SSA). Ultimately, the mind-set measure and essential exchange information are assembled, and LSTM is utilized to think about what the future cost of stocks will be. The tests show that the MS-SSA-LSTM model works better compared to the others and can be utilized in various circumstances. It was observed that adding the mind-set list can work on the model’s capacity to foresee. Likewise, the LSTM’s hyperparameters are upgraded utilizing SSA, which gives a more genuine clarification of the model’s boundary sets and improves the estimate impact. China’s financial market is extremely unstable, so making short- term predictions is better.

Deep learning, LSTM model, stock price pre- diction, sentiment analysis, sentiment dictionary, sparrow search algorithm.

As China’s stock market generates and Web finance evolves speedily, a usually accumulating number of people believe that it’s so fundamental to give and determine to join the monetary market. Getting the stock cost right can bring down the gamble of financial planning and increment the yields for organizations and customers. Before, scientists utilized measurements to fabricate a direct model that fit the pattern in stock costs over the long run. ARMA, ARIMA, GARCH, and other standard techniques are utilized. As a rule, these outdated ways can record coordinated and ordinary information. In any case, standard approaches to making forecasts depend on thoughts that don’t necessarily turn out as expected. Along these lines, it is difficult to utilize factual strategies to depict muddled monetary data. Artificial Neural Networks (ANN) and multi-layer ANN are utilized to take care of issues with monetary time series. In any case, the accompanying things should be possible to make the standard brain network strategy better. It’s not excellent at speculation, stalls out in overfitting rapidly, and winds up in neighborhood improvement. To fix these issues, we really want to find better models since we really want to prepare them on a ton of tests. To make the proposed model, we use temperament investigation, the multitude insight calculation, and profound figuring out how to blend the various kinds of information that influence stock costs. From that point forward, a great deal of specialists use ML methods like Support Vector Machines (SVM) and Neural Networks to attempt to think about what stock costs will do from here on out. It is the fundamental thought behind ML to utilize calculations to figure out information, gain from it, and think about what new information will show. A ton of specialists utilize the SVM to predict stocks since it is perfect at managing little gatherings, information with a ton of aspects, and circumstances that aren’t straight. As Hossain and Nasser( 6) set up, the SVM design is inferior at expecting stocks than the numerical one. Chai etal. (7) proposed a blended SVM model to forecast the ups and downs of the HS300 record. They start that the smallest places SVM was compatible accompanying the Genetic Algorithms GA) processed better. similarly again, when the SVM is utilized on enormous medicine sets, it’ll appropriate plenty thought and running time, that keep outline allure skill to prevision a lot of stock data. furthermore, Artificial Neural Network( ANN) and multilayer ANN are utilized to oversee issues in finances time series. The experimental outcomes show that ANN is great since it unites rapidly and is extremely precise [8, 9, 10]. Through tests, Moghaddam and Esfandyari [11] took a gander at how different feedforward artificial neural networks impacted their capacity to foresee the costs of stocks available. Utilizing the Bayesian regularization technique, Liu and Hou [12] made the BP (Back Propagation) neural network better. In any case, the accompanying things should be possible to make the standard neural network strategy better. It’s not awesome at speculation, stalls out in overfitting rapidly, and winds up in neighborhood advancement. To fix these issues, we want to find better models since we want to prepare them on a ton of tests. There is another model (MS-SSA- LSTM) in this study that attempts to foresee stock costs. It utilizes the Sparrow Search Algorithm and coordinates the highlights of multi-source information with LSTM neural networks. The MS-SSA-LSTM stock cost expectation model can tell you quite a bit early what the cost of a stock will be. This assists dealers and purchasers with pursuing better monetary decisions. Dealers and financial backers get data about the stocks they need to purchase, for example, past exchange information and data about what securities exchange proprietors have said, and afterward they put that data into the MS-SSA-LSTM model. The model in a flash makes a pattern diagram at the stock cost and thinks about what the cost will be the following day.

LITERATURE REVIEW

A. How to Handle Data Imbalance and Feature Selection Problems in CNN-Based Stock Price Forecasting:

Stock market predicting is a period series issue that attempts to think about what an action or stock could cost or move from here on out. Since there is a great deal of vulnerability in the stock information and it is impacted by such a large number of things, it is difficult to arrive at the objective utilizing standard time series techniques. In the examination, convolutional neural networks (CNN) models were utilized to foresee the securities exchange and functioned admirably. However, these models showed that the information was not adjusted due to issues with naming and picking highlights. To fix the issues, this study recommended another standard based naming technique and a better approach to pick highlights. Furthermore, a CNN-based model was made to think about how stocks in the Dow30 list would exchange the following day. This was finished to perceive how well the information marking and component determination technique worked. To take care of the CNN model, financial elements, gold, and oil value information were utilized to make various arrangements of picture based input factors. It was seen how well CNN models made forecasts contrasted with other examination that had previously been finished. In the tests, it was found that the CNN expectation model that involves the proposed techniques for marking and choosing highlights shows improvement over other CNN-based models that were important for different examinations. Additionally, the marking technique proposed works better to fix the stock information befuddle issue than Chen and Huang’s information adjusting strategy. The recurrence of marked information dropped from multiple times to 1.8 times with this technique.

B. A hybrid model integrating long short-term memory with adaptive genetic algorithm based on individual ranking for stock index prediction:

It has been a significant area of scholarly concentrate in money to display and foresee stock costs. The objective of this study is to see whether it is feasible to make forecasts about a stock file better by utilizing a blended model and adding monetary elements. To add to what has previously been expounded on foreseeing the financial exchange, we utilize a crossover model that joins wavelet transform (WT), long short- term memory (LSTM), and an adaptive genetic algorithm (AGA) in light of individual positioning to think about what will occur with the Dow Jones Industrial Average (DJIA) of the New York Stock Trade, the Norm and Unfortunate’s 500 (SP 500) file, the Nikkei 225 record of Tokyo, the Hang Seng File of Hong Kong The outcomes show that the AGA-LSTM model is better at foreseeing the stock file than the standard models all in all. With regards to anticipating six securities exchanges, the survey factors show that this model is more precise.

C. Optimal energy management of micro-grid using sparrow search algorithm:

A new metaheuristic strategy called sparrow search algo- rithm (SSA) is utilized in this review to deal with the activity of microgrid (MG) in the most ideal way conceivable. This paper concocts two improvement issues. The first is a solitary objective issue that attempts to bring down either the complete running expense or the all out yield from the framework. The subsequent issue has more than one objective; it incorporates both absolute running expense and all out contamination simultaneously. To utilize MG’s energy, another type of SSA is proposed. Photovoltaic panels (PV), wind turbines (WT), fuel cells (FC), micro-turbines (MT), batteries (BSS), and the network make up the MG that is being checked out. We analyzed the outcomes from the proposed SSA to those from the krill herd optimizer (KH), the Harris hawks optimizer (HHO), the artificial ecosystem-based optimizer (AEO), the fuzzy-self adaptive particle swarm optimisation (FSAPSO), and the antlion optimizer (ALO). For measurable assessment of the recommended calculation’s prosperity, non-parametric investigation with the Friedman and Kruskal-Wallis ANOVA tests are utilized. SSA was superior to KH at fixing the single- objective issue since it diminished cost and contamination by 1.44

D. Heavy metal content prediction based on Random Forest and Sparrow Search Algorithm:

X-ray fluorescence (XRF) research is an extraordinary method for figuring out what weighty metals are in soil. That’s what to do, we really want a precise conjecture model that is based on XRF research. Yet, in actuality, the XRF ghostly readings can be impacted by how wet the earth is, which could prompt wrong expectations. In this way, another gauge model was made utilizing Random Forest Regression (RFR) and a superior Sparrow Search Algorithm (SSA). This model considers changes in how much dampness present. Tests were utilized to get the XRF ghastly readings from the start. Since it can advance rapidly and make precise forecasts, the RFR was utilized to figure how much weighty metals present. To make RFR work better, the SSA was picked and improved with the possibility of valid statement sets. This makes it simple to track down the best hyper-boundaries for RFR. By examination, it tends to be seen that the proposed model works better compared to different models that are broadly utilized.

E. A Novel Improved Particle Swarm Optimization With Long- Short Term Memory Hybrid Model for Stock Indices Forecast:

Unpredictability in the securities exchange immensely affects numerous monetary and financial activities all over the planet. Foreseeing how stock costs will move is a critical piece of making a business arrangement or picking the best chance to exchange. However, changes in stock costs are loud, not straight, and muddled. It’s difficult to determine how stock patterns will help your profit from venture. We present another improved particle swarm optimisation (IPSO) and long-short term memory (LSTM) blend model at anticipating stock costs. To hold the model back from getting excessively near a neighborhood best too early, a versatile transformation factor was utilized as an action for streamlining. Similar to this, we demonstrated a nonlinear technique for increasing the particle swarm streamlining’s dormancy weight and then used the IPSO model to refine the LSTM hyperparameters. The results of the trial shown that the suggested model outperformed the help vector relapse, LSTM, and PSO-LSTM conventional models on the Australian stocks exchange record. These outcomes showed that the proposed model is entirely solid and can make great forecasts.

METHODOLOGY

They expounded on a blended model called EMD-LSSVM (empirical mode decomposition least squares support vector machine) that can be utilized to check out at the CSI 300 file and surmise what direction the financial exchange will move. They likewise utilize least squares support vector ma- chine (LSSVM) to make expectations and empirical mode decomposition (EMD) to break down informational indexes into various intrinsic mode functions (IMFs). To pick the portion capability’s qualities, different advancement strategies are utilized, for example, simplex, lattice search, molecule swarm improvement, and genetic calculation. They utilized union characteristics to make a blended recurrent neural network model in an alternate report to foresee what might occur in the Taiwan securities exchange. Combination highlight determination is utilized in their model to eliminate the quantity of variables expected to make a foreseeing model. A triumph measure called root mean squared error (RMSE) is utilized to judge how well their model functions

A. Disadvantages:

This implies that when the SVM is utilized on huge preparation sets, it will utilize a ton of memory and handling time, which could restrict its capacity to foresee a ton of stock information. Their model is for the most part founded on exact mode decay and support vector machines, which could make it harder to utilize different information sources and factors that influence stock costs. Their model can’t sort out how individuals feel about things like discussion posts, so they may be passing up helpful data about what financial backers feel and how that means for stock costs. It very well may be elusive the best hyperparameters for their model, particularly while managing confounded monetary information, which could result in under ideal execution. Their model experiences difficulty catching complex timing patterns and connections in stock cost information, particularly while checking out at information over longer timeframes. As a result of the issue with disappearing gradients. We propose a model called MS- SSA-LSTM that utilizes state of mind examination, the swarm intelligence algorithm, and deep learning out how to foresee future stock costs in light of a blend of various kinds of information that influences stock costs. In the first place, we glance through all of the East Cash string presents on make a novel state of mind word reference and sort out the feeling list. Then, the Long and Short-Term Memory organization

(LSTM) hyperparameters are improved by the Sparrow Search Algorithm (SSA). In conclusion, the temperament measure and fundamental exchange information are assembled, and LSTM is utilized to think about what the future cost of stocks will be. The model is prepared and tried on six arrangements of information that are run of the mill of individual stocks on the Chinese financial exchange. We do various tests on various models to perceive how well the proposed model functions.

B. Advantages:

This model considers consolidating information from various sources, like mind-set investigation and essential exchange information. This overall strategy gives the model consider more market factors, which could prompt more exact expectations. Our model purposes temperament investigation from East Cash gathering presents on provide us with a more complete image of how individuals feel about the market. By considering how financial backers feel, the model can more readily show how changes in stock costs are brought about by sentiments. The Sparrow Search Algorithm (SSA) is utilized by our model to make the LSTM hyperparameters work better. SSA’s multitude knowledge strategy assists find with bettering hyperparameter settings, which could prompt more exact expectations. Long Short-Term Memory (LSTM) networks are utilized in our model. LSTM networks are a kind of deep learning framework that is expected to record and depict time connections effectively. This assists the model better with understanding what complex time connections mean for stock cost information.

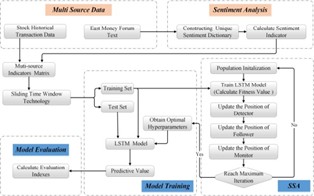

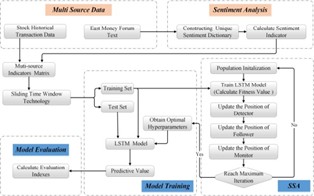

Fig. 1. System Architecture

C. MODULES:

To complete the above work, we have made the accompanying modules:

- This module is utilized for information disclosure; it loads information into the framework.

- This module is additionally utilized for handling; it peruses information for handling.

- Information will be parted into train and test utilizing this instrument.

- Building models for MLP - CNN - LSTM - MS-LSTM (Multi Source Data) - MS - SSA - LSTM (Multi Soucre -SSA optimizer) - Voting Regression. Computing the accuracy of calculations

- Client information exchange and login: This module will get clients to join and sign in.

- Client input: This module will allow clients to give forecasts.

- Forecast: the last expectation is shown

- As an expansion, we utilized an outfit approach that joined the predictions of a wide range of models to give a last forecast that was more reliable and accurate.

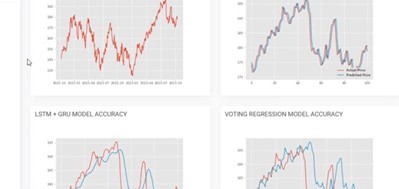

- To further develop execution significantly further, we might research more troupe approaches a Voting Clas- sifier and LSTM + GRU for stock sentiment, which delivered 100 percent accuracy, and Voting Regression for stock cost, which created close to 100

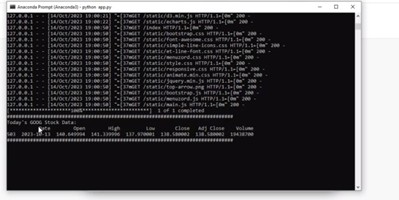

IMPLEMENTATION

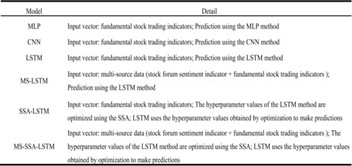

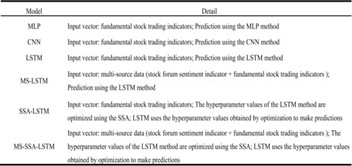

The following algorithms were used in this project:

- MLP: The Multilayer Perceptron Neural Network (MLP) is a type of neural network that has in addition to one layer, and so forth of those levels are connected for each different. A Backpropagation form is used to educate the model. Multilayer Perceptron, or MLP, is a type of Deep Learning. There must bother smallest three levels in an MLP: an input coating, an output layer, and a secret tier. The coatings must be sufficiently connected and feed forward.

- CNN: A CNN, more inscribed as ConvNet, is a type of deep learning network design that learns from data directly. CNNs are excellent for verdict currents in pictures that help you resolve what things, groups, and divisions they concern. They can more be excellent at arranging sounds, period order, and signal dossier into various groups.

- LSTM: LSTM is a distinctive somewhat Recurrent Neural Network that can solve the problem of vanishing gradients that RNN has. Hochreiter and Schmidhuber created LSTM, that fixes the issue that routine RNNs and machine learning algorithms are bearing. The Keras library maybe used to create LSTM introduce Python.

- MS-LSTM: The MS-LSTM (Multimodal Sequential Long Short-Term Memory) plan is a deep learning model fashioned to handle and analyse subsequent data that has as well individual type, like voice, television, or textbook. The new design add ornament to the original LSTM construction for fear that it can handle diversified types of complex data in the intervening time. This form it beneficial for tasks like understanding videos or analysing multimodal atmosphere.

- SSA-LSTM: It is a machine learning model that blends LSTM networks accompanying consideration machines to create series-located tasks more correct, exceptionally when skilled isn’t plenty branded dossier. The SSA- LSTM procedure endures ”Semi-Supervised Attention- based Long Short-Term Memory.” It increases order data reasoning in many fields, to a degree robotics and talk acknowledgment, by accumulating consideration processes and to a certain extent-directed education designs.

- MS-SSA-LSTM: The MS-SSA-LSTM is: It is an leading deep learning model that connects LSTM networks, consideration processes, and multimodal data conversion. The MS-SSA-LSTM form endures ”Multimodal Semi- Supervised Attention-based Long Short-Term Memory.” It can handle subsequent data in multiple ways and uses both semi-supervised learning means and consideration processes to form multimodal order-located tasks like multimedia content reasoning and character categorization more accurate and easy to understand.

- Voting Classifier (LSTM + GRU): LSTM and GRU are recurrent neural network (RNN) varieties that capability well for sequence data processing, whereas Voting Classifier integrates predictions from many ML models.

Fig. 2. Prediction Model

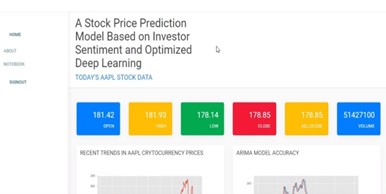

The stock price is influenced by the emotions of share- holders, and the LSTM network’s hyperparameters are often selected based on specific information. Thus, the MS-SSA- LSTM model for stock price prediction is implied by this work. Six sets of dossiers representative of individual equities on the Chinese stock market are used to develop and validate the model. In addition, the model’s prediction accuracy is verified using four assessment variables. We may get the following conclusions by comparing two objects. The MS- SSA-LSTM technique starts by examining many data sources. One way to look at the data is via historical transaction data, which contains information on closing prices, beginning prices, ending prices, and other details. On the other hand, information is derived from investors’ perceptions of the market. The model performs better when a mood indicator is included as input, as opposed to when it merely uses conventional stock trading indicators. The stock bar may be used to gauge investor sentiment in this manner. Policy administrators have the power to suppress early warnings and manipulate popular opinion. They may nevertheless assist possessors in budgeting wisely and preparing for probable fright or shouts. We persevere till we have a solid and organized stock request history. Secondly, the LSTM sceneries need to be altered in an unnatural manner, making it difficult to accept the fashionable vaticination outcomes. In order to make the LSTM model’s hyperparameters function better, the SSA was selected. This structure makes the model more flexible and depressed by creating indications, in addition to providing a more objective explanation for the model’s network construction and limit choices. The SSA-optimized Long Short-Term Memory (LSTM) model can swiftly and directly understand data rates in a challenging financial market, provide precise price forecasts, and reduce investor danger. In the end, experiments with six distinct stocks and models demonstrate how accurate, versatile, and trustworthy the MS- SSA-LSTM model is in the stock market. The results of the experiment indicate that optimal performance of the model’s prediction requires 5–10 time steps. This implies that given China’s very unstable financial system, short-term forecasts are preferable. This approach may be applied to other time series issues in the interim. Finally, the MS-SSA-LSTM type is universally applicable. Even though we limited our testing to the Chinese financial sector, the model is applicable to both domestic and international stock markets. The model receives input from a variety of sources. Basic stock data is one kind, and owner mood score is another. The Chinese and international stock markets include these data, which come from a variety of sources. There are several public social media platforms where users may discuss stock prices. As long as we can locate the stock comments, we may calculate the mood index and utilize it as one of the model’s inputs. Receiving input on the stock market is also made simple and fast by setting up a comment site. There are still some issues with our multi-source data in the MS-SSA-LSTM model. This study solely distinguishes between positive and negative sensations in terms of emotional analysis. Aside from these factors, the projection of stock price will also be impacted by policy changes and general economic conditions. Future study on emotions has to be expanded upon. We should search for a variety of emotional indicators in our research, such as fear, rage, contempt, and melancholy. More data sources, such as official Weibo and WeChat accounts, may be included in order to have a better understanding of public sentiment on the market. It is important to look for more information that may be used to forecast stock values using mining techniques.

The study is made as part of the academic project in IT at CBIT, Hyderabad. Key supporters in mobilizing resources, and technologies and compiling the objectives of the project are Supervisor R Sai Venkat, Co-Supervisors Dr. T. Prathima, Dr. Ramu Kuchipudi, Ramakrishna Kolikipogu, Head, Dr Rajanikanth A, and Principal Dr. C.V. Narasimhulu. Thanks to the Management of CBIT for providing all the necessary resources.

R. Sai Venkat*

R. Sai Venkat*

10.5281/zenodo.11798027

10.5281/zenodo.11798027